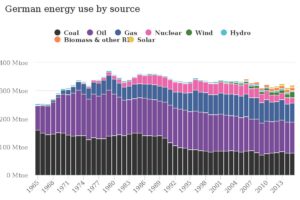

What you will find on this page: LATEST NEWS; Fossil fuel emissions have stalled; Analysis: Record surge of clean energy in 2024 halts China’s CO2 rise; does the world need hydrogen?; Mapped: global coal trade; Complexity of energy systems (maps); Mapped: Germany’s energy sources (interactive access); Power to the people (video); Unburnable Carbon (report); Stern Commission Review; Garnaut reports; live generation data; fossil fuel subsidies; divestment; how to run a divestment campaign guide; local council divestment guide; US coal plant retirement; oil conventional & unconventional; CSG battle in Australia (videos); CSG battle in Victoria; leasing maps for Victoria; coal projects Victoria

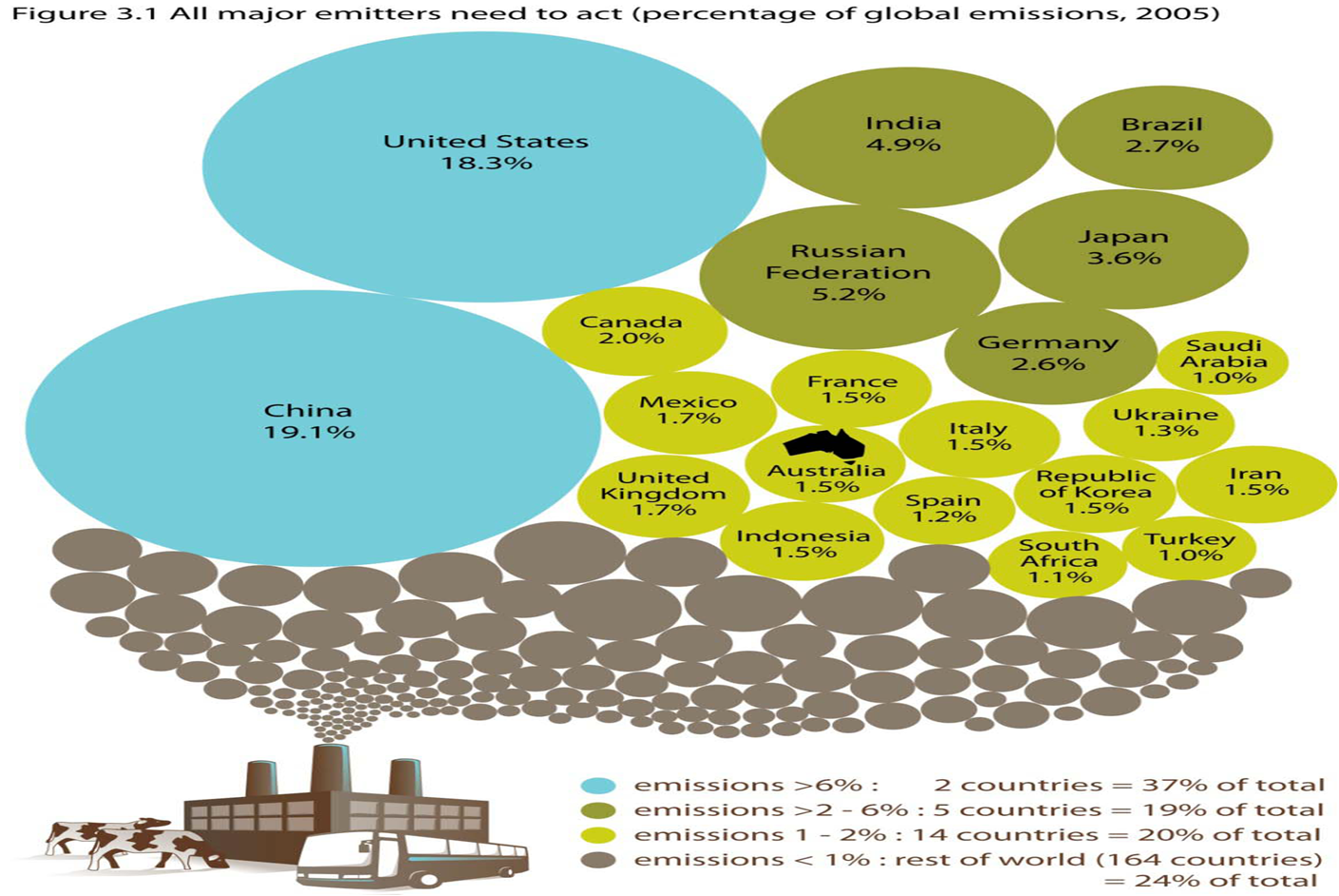

Huge task to decarbonise

Source: Australian Delegation presentation to international forum held in Bonn in May 2012

Latest News 17 December 2015, The Guardian, There is a new form of climate denialism to look out for – so don’t celebrate yet. After the signing of a historic climate pact in Paris, we might now hope that the merchants of doubt – who for two decades have denied the science and dismissed the threat – are officially irrelevant. But not so fast. There is also a new, strange form of denial that has appeared on the landscape of late, one that says that renewable sources can’t meet our energy needs. Oddly, some of these voices include climate scientists, who insist that we must now turn to wholesale expansion of nuclear power. Just this past week, as negotiators were closing in on the Paris agreement, four climate scientists held an off-site session insisting that the only way we can solve the coupled climate/energy problem is with a massive and immediate expansion of nuclear power. More than that, they are blaming environmentalists, suggesting that the opposition to nuclear power stands between all of us and a two-degree world. That would have troubling consequences for climate change if it were true, but it is not. Numerous high quality studies, including one recently published by Mark Jacobson of Stanford University, show that this isn’t so. We can transition to a decarbonized economy without expanded nuclear power, by focusing on wind, water and solar, coupled with grid integration, energy efficiency and demand management. In fact, our best studies show that we can do it faster, and more cheaply. Read more here 15 December 2015, Carbon Pulse, After Paris, UN’s new “light touch” role on markets to help spawn carbon clubs. It may take years for enough governments to ratify the new Paris Agreement for it to come into force, or to agree on the rules underpinning the new emissions trading mechanism enshrined by it, but any parties wanting to link up their carbon markets under the pact need not wait. The agreement approved by 195 governments in the French capital on Saturday carried provisions effectively setting up two tracks for the use of market-based mechanisms in meeting nations’ emissions reduction pledges, now officially known as Nationally Determined Contributions (NDCs). Article 6.4 of the agreement takes a centralised approach, establishing a market-based mechanism akin to the Kyoto Protocol’s CDM or JI, which is to be developed by countries between now and 2020. It will create a new type of carbon unit that, similar to those generated under Kyoto, can be used by governments that have ratified the agreement. Articles 6.2 and 6.3, on the other hand, allow for decentralised ‘cooperative approaches’ that let countries and other jurisdictions with markets bilaterally and multilaterally link them together, in what many now refer to as ‘carbon clubs’. These clubs will now be able to trade units, recognised under the Paris Agreement as being “Internationally Transferrable Mitigation Outcomes”, or ITMOs, that are backed by robust accounting measures and not counted more than once towards a country’s target. These cooperative approaches, says Jeff Swartz, director of international policy at IETA, “set up the framework for a much deeper world of cooperation” on carbon markets. “It says ‘here’s a framework, some basic rules of the road’. It’s different from Kyoto’s top-down approach in that it lets countries drive,” added Nat Keohane, vice president for global climate at US-based Environmental Defense Fund (EDF). Both spoke to reporters on Tuesday in a conference call hosted by the two organisations. Read More here 15 December 2015, Carbon Brief, The world has spoken. It wants to limit future temperatures rises to 1.5C above historic levels. To achieve this everything must change. The twelfth of December 2015 may well be remembered as the day the human race came together and saved the world. Old differences between rich and poor, west and east were laid aside. Unbeknownst to anyone, six months ago and in secret, the sinking Marshall islanders started to raise an army of more than 100 ambitious nations that rose above the flotsam and jetsam of self-interest and created a stronger climate agreement than anyone thought possible. The Paris agreement aims to hold the increase in the global average temperatures to “well below 2C above pre-industrial levels” and to “pursue efforts to limit the temperature increase to 1.5C”. It also requires parties to produce audited emission-reduction commitments ratcheting up every five years, and delivers a “floor” of $100 billion per year of financing up to 2025. So unexpected was this that we climate scientists were caught napping. Before Paris, we all thought 2C was a near-impossible target and spent our energies researching future worlds where temperatures soared. In fact, there is still much to discover about the specific advantages of limiting warming to 1.5C, and the plausible social and economic pathways that might keep us under this limit. Some have derided the 1.5C target as a pipe dream, given that current national pledges to reduce carbon dioxide emissions – known as Intended Nationally Determined Contributions (INDCs) – could bring us closer to 3C. However, the limited research that does exist suggests that it is possible to overshoot 1.5C and return below it by 2100. And the figure below illustrates how a five-year ratchet mechanism of increasingly ambitious INDCs could deliver a temperature close to 1.5C by 2100. Read More here

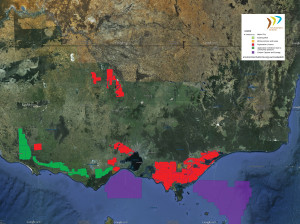

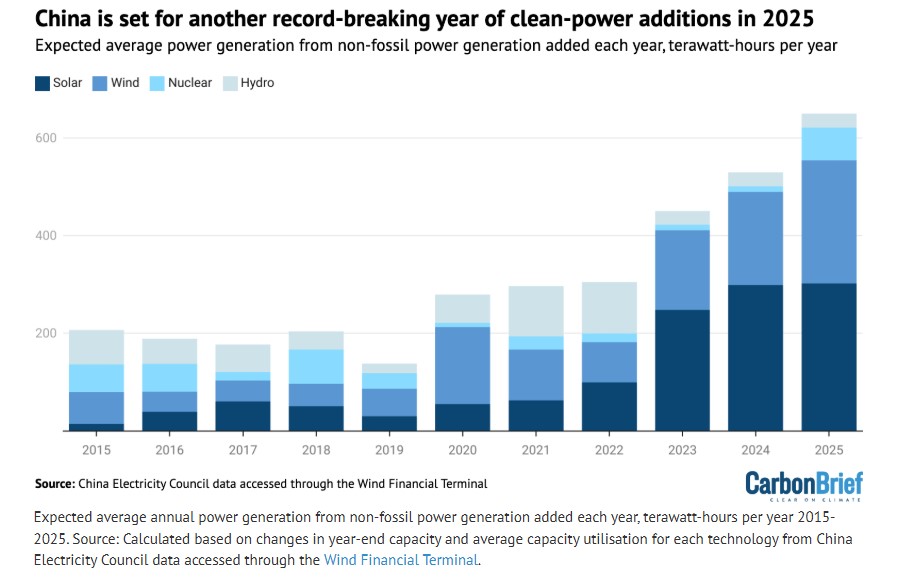

14 December 2015, Renew Economy, Hidden gem in Paris deal condemns coal to early demise. When France foreign minister Laurent Fabius brought the gavel down on Saturday night and declared the Paris Agreement on climate change action was sealed, the reaction was almost immediate. Within the conference hall it was greeted with cheers, hugging and great emotion. Outside, the agreement to cap temperature rises “well below 2°C” and as low as 1.5°C signalled a remarkable achievement that had one major implication: the end of the fossil fuel era is nigh. ….But if that is what the fossil fuel industry and the Coalition government are really thinking, then the evidence suggests that they are kidding themselves. One little gem, alerted to me by the Potsdam Institute’s Malter Meinshausen (on the dance floor of the COP after party of all places) puts the agreement in a new perspective. It is this paragraph, article 17, in the decisions text of the deal: “Clause 17. Notes with concern that the estimated aggregate greenhouse gas emission levels in 2025 and 2030 resulting from the intended nationally determined contributions do not fall within least-cost 2 ̊C scenarios but rather lead to a projected level of 55 gigatonnes in 2030, and also notes that much greater emission reduction efforts will be required than those associated with the intended nationally determined contributions in order to hold the increase in the global average temperature to below 2 ̊C above pre-industrial levels by reducing emissions to 40 gigatonnes or to 1.5 ̊C above pre-industrial levels by reducing to a level to be identified in the special report referred to in paragraph 21 below”; OK, now for a quick translation. The world currently emits around 50 gigatonnes of greenhouse gas emissions a year. Even if all the pledges put together by 186 nations before and during the Paris climate talks were enacted, these emissions would grow to around 55 gigatonnes of GHG emissions a year by 2030. But to meet the 2°C target, the world will need to reduce those emissions to 40 gigatonnes a year. And to reach that level, they are likely going to have to reverse direction before 2020. What’s more, if the world does move to that aspirational goal of capping temperatures to 1.5°C above pre-industrial levels, then it is going to have to move a lot faster, and a lot more dramatically than that. That trajectory will be outlined by a new IPCC report due in 2018. Read More here 5 June 2017, Renew Economy, “Reputation” clause may scupper government loan deal for Adani. The federal government’s ability to hand Adani Energy a $1 billion loan to help finance the rail link for the Carmichael coal project in the Galilee basin has been dealt a decisive blow by the emergence of a “reputation” clause that must guide the board of Northern Australia Infrastructure Facility (NAIF). The Board of NAIF is expected to make a decision on whether to grant the funding in the next few days, but legal experts, financiers and environmental advocates argue that the existence of the reputation clause written in to the investment mandate by then resources minister Josh Frydenberg make it impossible for approval to be given. Leading environmentalists and climate change advocates such as Tim Flannery and John Hewson says the wording of the “reputation” clause should forbid the directors from supporting the loan, particularly in light of the international climate deal, the impacts on the Greater Barrier Reef, and on water quality. They say that Section 16 of the Investment Mandate of the NAIF, a $5 billion fund created by the Coalition government that is yet to make a single investment, is quite clear and specific: Read More here 29 May 2017, Renew Economy, The myth that Adani coal is boom or bust for Queensland economy. There are a whole bunch of reasons why the Adani coal mine does not make sense: for the environment, the climate and on basic economics. The latest results from Adani Power, revealing over the weekend a $US954 million loss ($A1.3 billion) for the last financial year, its fifth loss in a row, and a growing preference for domestic over imported coal, not to mention the endless delays and requests for government support, underline the fact that the project makes no financial sense. And we know that on environmental and climate grounds, it makes no sense either. Rescuers minister Matt Canavan counts Adani’s benefits on the basis that the mine will last 60 years. That timeframe assumes that the world will not act on climate change. Another myth that refuses to go away, and seems to be prosecuted by everyone from the Coalition, to the state Labor government and to the local councils, is that the Queensland economy depends on Adani and its Carmichael mine for jobs and investment, and that the region’s economy would be devastated if the mine didn’t go ahead. It is simply not true. For a start, the inflated figures being pedalled by those state and federal politicians – the claim of 10,000 jobs – have been debunked by Adani itself, and its more modest investment plans now suggest maybe one-tenth of that, at best. And perhaps those politicians should have a look around and see what else is happening in the region. It is really quite stunning: some 4,200MW of large-scale wind and solar projects, all of them in central to northern Queensland, and billions of dollars worth of other projects in the pipeline, including biofuels and even a battery gigafactory in Townsville. Read More here 24 May 2017, DeSmogUK, Op-Ed: Glacial Progress at Bonn Climate Talks Shows Why we Need to Exclude Big Polluters From Negotiations. When it comes to the fossil fuel industry participating in UN climate negotiations, it’s clear there is a conflict of interest – and demands for this to end are nothing new. But after fierce resistance to this idea during talks in Bonn last week from the EU, US and Australia, more needs to be done, argues Pascoe Sabido of Corporate Europe Observatory. With just six months to go before November’s COP23 climate negotiations, calls for big polluters to be excluded from the talks are growing. Last May at the same ‘intersessional’ climate talks in Bonn, a group of countries representing more than 70 percent of the world’s population insisted on adding a conflict of interest provision in the negotiating text. It almost made it, were it not for an underhand move by the European Union and the USA which saw it removed. Pulling the strings behind such moves: the world’s largest fossil fuel companies. Taken to its logical conclusion, addressing conflicts of interest would mean kicking out the same corporations whose profits are built on causing climate change. Research shows that at least 80 per cent of known fossil fuel reserves need to be kept in the ground to keep global warming below 2 degrees, let alone 1.5 degrees. But a look at BP and Shell’s future energy projections allege that we can continue to burn fossil fuels indefinitely. Ending fossil fuels would put them out of business. This is a fundamental conflict of interest, yet getting it even discussed – let alone addressed – has been an uphill struggle. However, persistence of those countries at the frontline of climate change – particularly Ecuador, which is seeing increasing water shortages and crop failures – as well as increasing public outrage and civil society’s call on the UN to ‘Kick Big Polluters Out’ of climate policy, has ensured the issue has remained on the agenda. This year’s two-week intersessional talks in Bonn saw an official workshop on the topic organised by the secretariat of the United Nations Convention on Climate Change (UNFCCC). Read More here 11 May 2017, Renew Economy, Budget papers reveal jobs to grow at CEFC, but CCA left without funds. While the Turnbull government’s second budget distinguished itself for its complete lack of provisions for – or even references to – climate change, RenewEconomy did notice that the papers flagged an increase in staff numbers at the Clean Energy Finance Corporation, from 80 people to 101. According to the CEFC, the staff increase noted in the budget reflects the green bank’s expectation that it will need more hands on deck to manage its “expanding and diversified” investment portfolio. And that’s because it is doing very well. “The budget papers show that we are forecast to exceed the target $800 million to $1 billion of new contracted investments during 2016/17, which is a considerable step up in the level of investment over prior periods,” a CEFC spokesperson told RE in an email. “As the CEFC’s investment portfolio progressively grows (currently $1.5 billion invested and $3 billion committed of the $10 billion appropriated to CEFC), the Board of the CEFC must ensure it has the requisite resources in place to properly manage those investments and associated business risks, on behalf of the Australian taxpayer, in an efficient and effective manner,” the email said. The extra funds contrasts with the fate of the Climate Change Authority, which has been effectively defenestrated by the Coalition government. Once again, its funding does not extend beyond the coming financial year, as the Coalition repeats its desire to close the authority. The CCA, established by Labor and the Greens to provide independent advice on climate targets and policies, has been embroiled in controversy in recent months, leading to resignations from key board members such as Clive Hamilton and John Quiggin, over what they described as compromised reports. But even these have been ignored by the Coalition. The CEFC has also been on the coalition’s hit list, but is now tolerate given it has chalked up an impressive track record since its inception in 2013. The LNP has shifted from describing the CEFC as a “giant green hedge fund” or “honeypot to every white-shoe salesman imaginable,” to claiming it as a major national success; one that marked its third year of operation with a record $837 million committed to new clean energy investments, contributing to projects with a total value of $2.5 billion, and achieving a 73 per cent year-on-year increase in the value of new investment commitments. Read more here May 2022, Climate Council Report: UNINSURABLE NATION: AUSTRALIA’S MOST CLIMATE-VULNERABLE PLACES. Climate Change, driven by the burning of coal, oil and gas is supercharging our weather systems. While climate change affects all Australians, the risks are not shared equally. In the most extreme instances, areas may become uninhabitable. Worsening extreme weather means increased costs of maintenance, repair and replacement to properties – our homes, workplaces and commercial buildings. As the risk of being affected by extreme weather events increases, insurers will raise premiums to cover the increased cost of claims and reinsurance. Insurance will become increasingly unaffordable or unavailable in large parts of Australia due to worsening extreme weather. This report outlines the top 20 most at-risk federal electorates to climate change-related extreme weather events, providing a brief profile of the top 10. The report also outlines the most at risk electorates for each state and territory. Check out our Climate Risk Map to see if your area is at risk. Link to report here. 24 May 2022, Renew Economy: Albanese commits Australia to stronger 2030 target, starts climate reset. Prime minister Anthony Albanese has commenced a reset of Australia’s international climate action commitments, formalising its commitment to a stronger 2030 reduction target in his first address to a major international forum. Just a day after being sworn in, Albanese is in Tokyo for the ‘Quad’ meeting with the leaders of Japan, India and the United States to discuss collaboration between the four regional powers and how they can rebuild relationships across the Pacific region. Albanese used his opening address to formally commit Australia to the stronger 2030 emissions reduction target that Labor had taken to the election, saying that delivering climate action was a key diplomatic challenge in the Indo-Pacific region. “The region is looking to us to work with them and to lead by example. That’s why my government will take ambitious action on climate change and increase our support to partners in the region as they work to address it, including with new finance,” Albanese told the meeting. “We will act in recognition that climate change is the main economic and security challenge for the island countries of the Pacific. Under my government, Australia will set a new target to reduce emissions by 43 per cent by 2030, putting us on track for net zero by 2050.” It represents the first time since the Abbott government in 2015 that Australia has committed to increasing its 2030 emissions reduction target. The outgoing Morrison government had held firm to Abbott’s 26 to 28 per cent reduction target – a goal long seen as inadequate both domestically and among Australia’s international peers. Read more here 11 May 2022, The Guardian: ‘Devastating’: 91% of reefs surveyed on Great Barrier Reef affected by coral bleaching in 2022. Coral bleaching affected 91% of reefs surveyed along the Great Barrier Reef this year, according to a report by government scientists that confirms the natural landmark has suffered its sixth mass bleaching event on record. The Reef snapshot: summer 2021-22, quietly published by the Great Barrier Reef Marine Park Authority on Tuesday night after weeks of delay, said above-average water temperatures in late summer had caused coral bleaching throughout the 2,300km reef system, but particularly in the central region between Cape Tribulation and the Whitsundays. “The surveys confirm a mass bleaching event, with coral bleaching observed at multiple reefs in all regions,” a statement accompanying the report said. “This is the fourth mass bleaching event since 2016 and the sixth to occur on the Great Barrier Reef since 1998.” It was the first mass bleaching event recorded during a cooler La Niña year. Scientists from the marine park authority and the Australian Institute of Marine Science surveyed 719 shallow water reefs between the Torres Strait and the Capricorn Bunker Group at the southern end of the reef system, mostly using helicopters. They found 654 reefs showed some bleaching. Read more here. 11 May 2022, The Guardian: ‘Devastating’: 91% of reefs surveyed on Great Barrier Reef affected by coral bleaching in 2022. Coral bleaching affected 91% of reefs surveyed along the Great Barrier Reef this year, according to a report by government scientists that confirms the natural landmark has suffered its sixth mass bleaching event on record. The Reef snapshot: summer 2021-22, quietly published by the Great Barrier Reef Marine Park Authority on Tuesday night after weeks of delay, said above-average water temperatures in late summer had caused coral bleaching throughout the 2,300km reef system, but particularly in the central region between Cape Tribulation and the Whitsundays. “The surveys confirm a mass bleaching event, with coral bleaching observed at multiple reefs in all regions,” a statement accompanying the report said. “This is the fourth mass bleaching event since 2016 and the sixth to occur on the Great Barrier Reef since 1998.” It was the first mass bleaching event recorded during a cooler La Niña year. Scientists from the marine park authority and the Australian Institute of Marine Science surveyed 719 shallow water reefs between the Torres Strait and the Capricorn Bunker Group at the southern end of the reef system, mostly using helicopters. They found 654 reefs showed some bleaching. Read more here 27 January 2025, Carbon Brief: A record surge of clean energy kept China’s carbon dioxide (CO2) emissions below the previous year’s levels in the last 10 months of 2024. However, the new analysis for Carbon Brief, based on official figures and commercial data, shows the tail end of China’s rebound from zero-Covid in January and February, combined with abnormally high growth in energy demand, stopped CO2 emissions falling in 2024 overall. While China’s CO2 output in 2024 grew by an estimated 0.8% year-on-year, emissions were lower than in the 12 months to February 2024. Other key findings of the analysis include: As ever, the latest analysis shows that policy decisions made in 2025 will strongly affect China’s emissions trajectory in the coming years. In particular, both China’s new commitments under the Paris Agreement and the country’s next five-year plan are being prepared in 2025. Read More Here 3 November 2020, Carbon Brief: Hydrogen gas has long been recognised as an alternative to fossil fuels and a potentially valuable tool for tackling climate change. Now, as nations come forward with net-zero strategies to align with their international climate targets, hydrogen has once again risen up the agenda from Australia and the UK through to Germany and Japan. In the most optimistic outlooks, hydrogen could soon power trucks, planes and ships. It could heat homes, balance electricity grids and help heavy industry to make everything from steel to cement. But doing all these things with hydrogen would require staggering quantities of the fuel, which is only as clean as the methods used to produce it. Moreover, for every potentially transformative application of hydrogen, there are unique challenges that must be overcome. In this in-depth Q&A – which includes a range of infographics, maps and interactive charts, as well as the views of dozens of experts – Carbon Brief examines the big questions around the “hydrogen economy” and looks at the extent to which it could help the world avoid dangerous climate change. Access full article here Fossil fuel emissions have stalled 14 November 2016, The Conversation, Fossil fuel emissions have stalled: Global Carbon Budget 2016. For the third year in a row, global carbon dioxide emissions from fossil fuels and industry have barely grown, while the global economy has continued to grow strongly. This level of decoupling of carbon emissions from global economic growth is unprecedented.Global CO₂ emissions from the combustion of fossil fuels and industry (including cement production) were 36.3 billion tonnes in 2015, the same as in 2014, and are projected to rise by only 0.2% in 2016 to reach 36.4 billion tonnes. This is a remarkable departure from emissions growth rates of 2.3% for the previous decade, and more than 3% during the 2000’s. Read More here Do you want to understand the complexity of energy systems which support our high consumption lifestyles? Most people don’t give too much thought to where their electricity comes from. Flip a switch, and the lights go on. That’s all. The origins of that energy, or how it actually got into our homes, is generally hidden from view. This link will take you to 11 maps which explain energy in America (it is typical enough as an example of a similar lifestyle as Australia – when I find maps for Oz I’ll add them in) e.g. above map showing the coal plants in the US. Source: Vox Explainers Mapped: how Germany generates its electricity – another example Power to the People – Lock the Gate looks back at the wins of 2015 And there’s lots more coming up in 2016. Some of the big priorities coming up next for the “Lock the Gate” movement are: If you want to give “Lock the Gate” your support – go here for more info This new report reveals that the pollution from Australia’s coal resources, particularly the enormous Galilee coal basin, could take us two-thirds of the way to a two degree rise in global temperature. To Read More and download report The 2006 UK government commissioned Stern Commission Review on the Economics of Climate Change is still the best complete appraisal of global climate change economics. The review broke new ground on climate change assessment in a number of ways. It made headlines by concluding that avoiding global climate change catastrophe was almost beyond our grasp. It also found that the costs of ignoring global climate change could be as great as the Great Depression and the two World Wars combined. The review was (still is) in fact a very good assessment of global climate change, which inferred in 2006 that the situation was a global emergency. Read More here The Garnaut Climate Change Review was commissioned by the Commonwealth, state and territory governments in 2007 to conduct an independent study of the impacts of climate change on the Australian economy. Prof. Garnaut presented The Garnaut Climate Change Review: Final Report to the Australian Prime Minister, Premiers and Chief Ministers in September 2008 in which he examined how Australia was likely to be affected by climate change, and suggested policy responses. In November 2010, he was commissioned by the Australian Government to provide an update to the 2008 Review. In particular, he was asked to examine whether significant changes had occurred that would affect the analysis and recommendations from 2008. The final report was presented May 2011. Since then the Professor has regularly participated in the debate of fossil fuel reduction, as per his latest below: To access his reports; interviews; submissions go here 27 May 2015, Renew Economy, Garnaut: Cost of stranded assets already bigger than cost of climate action. This is one carbon budget that Australia has already blown. Economist and climate change advisor Professor Ross Garnaut has delivered a withering critique of Australia’s economic policies and investment patterns, saying the cost of misguided over-investment in the recent mining boom would likely outweigh the cost of climate action over the next few decades. Read More here Live generation of electricity by fuel type Fossil Fuel Subsidies – The Age of entitlement continues 24 June 2014, Renew Economy, Age of entitlement has not ended for fossil fuels: A new report from The Australia Institute exposes the massive scale of state government assistance, totalling $17.6 billion over a six-year period, not including significant Federal government support and subsidies. Queensland taxpayers are providing the greatest assistance by far with a total of $9.5 billion, followed by Western Australia at $6.2 billion. The table shows almost $18 billion dollars has been spent over the past 6 years by state governments, supporting some of Australia’s biggest, most profitable industries, which are sending most of the profits offshore. That’s $18 billion dollars that could have gone to vital public services such as hospitals, schools and emergency services. State governments are usually associated with the provision of essential services like health and education so it will shock taxpayers to learn of the massive scale of government handouts to the minerals and fossil fuel industries. This report shows that Australian taxpayers have been misled about the costs and benefits of this industry, which we can now see are grossly disproportionate. Each state provides millions of dollars’ worth of assistance to the mining industry every year, with the big mining states of Queensland and Western Australia routinely spending over one billion dollars in assistance annually. Read More here – access full report here What is fossil fuel divestment? Local Governments ready to divest Aligning Council Money With Council Values A Guide To Ensuring Council Money Isn’t Funding Climate Change. 350.org Australia – with the help of the incredible team at Earth Hour – has pulled together a simple 3-step guide for local governments interested in divestment. The movement to align council money with council values is constantly growing in Australia. It complements the existing work that councils are doing to shape a safe climate future. It can also help to reshape the funding practices of Australia’s fossil fuel funding banks. The steps are simple. The impact is huge.The guide can also be used by local groups who are interested in supporting their local government to divest as a step-by-step reference point. Access guide here How coal is staying in the ground in the US Sierra Club Beyond Coal Campaign May 2015, Politico, Michael Grunwald: The war on coal is not just political rhetoric, or a paranoid fantasy concocted by rapacious polluters. It’s real and it’s relentless. Over the past five years, it has killed a coal-fired power plant every 10 days. It has quietly transformed the U.S. electric grid and the global climate debate. The industry and its supporters use “war on coal” as shorthand for a ferocious assault by a hostile White House, but the real war on coal is not primarily an Obama war, or even a Washington war. It’s a guerrilla war. The front lines are not at the Environmental Protection Agency or the Supreme Court. If you want to see how the fossil fuel that once powered most of the country is being battered by enemy forces, you have to watch state and local hearings where utility commissions and other obscure governing bodies debate individual coal plants. You probably won’t find much drama. You’ll definitely find lawyers from the Sierra Club’s Beyond Coal campaign, the boots on the ground in the war on coal. Read More here Oil – conventional & unconventional May 2015, Oil change International Report: On the Edge: 1.6 Million Barrels per Day of Proposed Tar Sands Oil on Life Support. The Canadian tar sands is among the most carbon-intensive, highest-cost sources of oil in the world. Even prior to the precipitous drop in global oil prices late last year, three major projects were cancelled in the sector with companies unable to chart a profitable path forward. Since the collapse in global oil prices, the sector has been under pressure to make further cuts, leading to substantial budget cuts, job losses, and a much more bearish outlook on expansion projections in the coming years. Read full report here. For summary of report USA Sierra Club Beyond Oil Campaign Coal Seam Gas battle in Australia Lock the Gate Alliance is a national coalition of people from across Australia, including farmers, traditional custodians, conservationists and urban residents, who are uniting to protect our common heritage – our land, water and communities – from unsafe or inappropriate mining for coal seam gas and other fossil fuels. Read more about the missions and principles of Lock the Gate. Access more Lock the Gate videos here. Access Lock the Gate fact sheets here 2014: Parliament of Victoria Research Paper: Unconventional Gas: Coal Seam Gas, Shale Gas and Tight Gas: This Research Paper provides an introduction and overview of issues relevant to the development of unconventional gas – coal seam, shale and tight gas – in the Australian and specifically Victorian context. At present, the Victorian unconventional gas industry is at a very early stage. It is not yet known whether there is any coal seam gas or shale gas in Victoria and, if there is, whether it would be economically viable to extract it. A moratorium on fracking has been in place in Victoria since August 2012 while more information is gathered on potential environmental risks posed by the industry. The parts of Victoria with the highest potential for unconventional gas are the Gippsland and Otway basins. Notably, tight gas has been located near Seaspray in Gippsland but is not yet being produced. There is a high level of community concern in regard to the potential impact an unconventional gas industry could have on agriculture in the Gippsland and Otway regions. Industry proponents, however, assert that conventional gas resources are declining and Victoria’s unconventional gas resources need to be ascertained and developed. Read More here 28 January 2015, ABC News, Coal seam gas exploration: Victoria’s fracking ban to remain as Parliament probes regulations: A ban on coal seam gas (CSG) exploration will stay in place in Victoria until a parliamentary inquiry hands down its findings, the State Government has promised. There is a moratorium on the controversial mining technique, known as fracking, until the middle of 2015. The Napthine government conducted a review into CSG, headed by former Howard government minister Peter Reith, which recommended regulations around fracking be relaxed. Labor was critical of the review, claiming it failed to consult with farmers, environmental scientists and local communities. Read more here Keep up to date and how you can be involved here Friends of the Earth Melbourne Coal & Gas Free Victoria 20 May 2015, FoE, Inquiry into Unconventional Gas: Check here for details on the Victorian government’s Inquiry into unconventional gas. The public hearings have not yet started, however the Terms of Reference have been released. The state government’s promised Inquiry into Unconventional Gas has now been formally announced, with broad terms of reference (TOR). FoE’s response to the TOR is available here. The Upper House Environment and Planning Committee will manage the Inquiry. You can find the Inquiry website here. The final TOR will be determined by the committee. Significantly, it is a cross party committee. The Chair is a Liberal (David Davis), and there is one National (Melinda Bath), one Green (Samantha Dunn), three from the ALP (Gayle Tierney, Harriet Shing, Shaun Leane), an additional MP from the Liberals (Richard Dalla-Riva), and one MP from the Shooters Party (Daniel Young). Work started by the previous government, into water tables and the community consultation process run by the Primary Agency, will be released as part of the inquiry.The moratorium on unconventional gas exploration will stay in place until the inquiry delivers its findings. The interim report is due in September and the final report by December. There is the possibility that the committee will amend this timeline if they are overwhelmed with submissions or information. Parliament will then need to consider the recommendations of the committee and make a final decision about how to proceed. This is likely to happen when parliament resumes after the summer break, in early 2016. Quit Coal is a Melbourne-based collective that campaigns against the expansion of the coal and unconventional gas industries in Victoria. Quit Coal uses a range of tactics to tackle this problem. We advise the broader Victorian community about plans for new coal and unconventional gas projects, we put pressure on our government to stop investing in these projects, and we help to inform and mobilise Victorian communities so they can campaign on their own behalf. We focus on being strategic, creative, and as much as possible, fun! The above screen shot is of the Victorian State government’s Mining Licences Near Me site. Go to this link to see what is happening in your area Environment Victoria’s campaign CoalWatch is an interactive resource that tracks the coal industry’s expansion plans and helps builds a movement to stop these polluting developments. CoalWatch provides a way for everyday Victorians to keep track of the coal industry’s ambitious expansion plans. To check what tax-payer money has been pledged to brown coal projects and the coal projects industry is spruiking to our politicians. Here’s another map via EV website (go to their website and you should be able to get better detail from Google Maps: Red areas: Exploration licences (EL). These areas are held by companies to undertake exploration activity. A small bond is held by government in case of any damage. If a company wants to progress the project it needs to obtain a mining licence. Exploration Licence applications are marked with an asterix in the Places Index eg. EL4684*. Yellow areas: Mining Licences (MIN). A mining licence is granted with the expectation that mining will occur. A larger bond is paid to government. Green areas: Exploration licences that have been withdrawn or altered due to community concern. Green outline: Existing mines within Mining Licences. Purple areas: Geological Carbon Storage Exploration areas for carbon capture and storage. On-shore areas have been released by the State Government, while off-shore areas have been released by the Federal Government. The Coal Watch wiki tracks current and future Victorian coal projects, whether they are power stations, coal mines, proposals to export coal or some other inventive way of burning more coal. To get the full picture of coal in Victoria visit our wiki page. Get more info and see the full list of Exploration Licences current at 17 August 2012 here August 2015, Institute for Energy Economics & Financial Analysis – powerpoint: Changing Dynamics in the Global Seaborne Thermal Coal Markets and Stranded Asset Risk. Information from one of the slides follows. To view full presentation go here Economic Implications for Australia 83% of Australian coal mines are foreign owned, hence direct leverage of fossil fuels to the ASX is relatively small at 1-2%. However, for Australia the exposure is high, time is needed for transition and the new industry opportunities are significant: 1. Energy Infrastructure: Australia spends $5-10bn pa on electricity / grid sector, much of it a regulated asset base that all ratepayers fund much of it stranded. BNEF estimate of Australia’s renewable energy infrastructure investment for 2015-2020 was cut 30% from A$20bn post RET. Lost opportunities. 2. Direct employment: The ABS shows a fall of ~20k from the 2012 peak of 70K from coal mining across Australia, and cuts are ongoing. Indirect employment material. 3. Terms of trade: BZE estimates the collapse in the pricing of iron ore, coal and LNG cuts A$100bn pa from Australia’s export revenues by 2030, a halving relative to government budget estimates of 2013/14. Coal was 25% of NSW’s total A$ value of exports in 2013/14 (38% of Qld). Australia will be #1 globally in LNG by 2018. 4. The financial sector: is leveraged to mining and associated rail port infrastructure. WICET 80% financed by banks, mostly Australian. Adani’s Abbot Point Port is foreign owned, but A$1.2bn of Australian sourced debt. Insurance firms and infrastructure funds are leveraged to fossil fuels vs little RE infrastructure assets. BBY! 5. Rehabilitation: $18bn of unfunded coal mining rehabilitation across Australia. 6. Economic growth: curtailed as Australia fails to develop low carbon industries. Analysis: Record surge of clean energy in 2024 halts China’s CO2 rise

In-depth Q&A: Does the world need hydrogen to solve climate change?

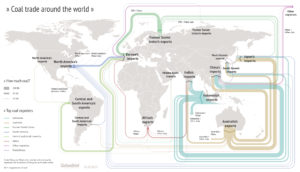

3 May 2016, Carbon Brief, The global coal trade doubled in the decade to 2012 as a coal-fueled boom took hold in Asia. Now, the coal trade seems to have stalled, or even gone into reverse. This change of fortune has devastated the coal mining industry, with Peabody – the world’s largest private coal-mining company – the latest of 50 US firms to file for bankruptcy. It could also be a turning point for the climate, with the continued burning of coal the biggest difference between business-as-usual emissions and avoiding dangerous climate change. Carbon Brief has produced a series of maps and interactive charts to show how the global coal trade is changing. As well as providing a global overview, we focus on a few key countries: Read More here

3 May 2016, Carbon Brief, The global coal trade doubled in the decade to 2012 as a coal-fueled boom took hold in Asia. Now, the coal trade seems to have stalled, or even gone into reverse. This change of fortune has devastated the coal mining industry, with Peabody – the world’s largest private coal-mining company – the latest of 50 US firms to file for bankruptcy. It could also be a turning point for the climate, with the continued burning of coal the biggest difference between business-as-usual emissions and avoiding dangerous climate change. Carbon Brief has produced a series of maps and interactive charts to show how the global coal trade is changing. As well as providing a global overview, we focus on a few key countries: Read More here/cdn0.vox-cdn.com/uploads/chorus_asset/file/3915730/EIA%20coal%20power%20plants.png)

21 April 2015, Climate Council, Will Steffen: Unburnable Carbon: Why we need to leave fossil fuels in the ground.Stern Commission Review

Australia’s Garnaut Review

November 2014 – The Fossil Fuel Bailout: G20 subsidies for oil, gas and coal exploration report: Governments across the G20 countries are estimated to be spending $88 billion every year subsidising exploration for fossil fuels. Their exploration subsidies marry bad economics with potentially disastrous consequences for climate change. In effect, governments are propping up the development of oil, gas and coal reserves that cannot be exploited if the world is to avoid dangerous climate change. This report documents, for the first time, the scale and structure of fossil fuel exploration subsidies in the G20 countries. The evidence points to a publicly financed bailout for carbon-intensive companies, and support for uneconomic investments that could drive the planet far beyond the internationally agreed target of limiting global temperature increases to no more than 2ºC. It finds that, by providing subsidies for fossil fuel exploration, the G20 countries are creating a ‘triple-lose’ scenario. They are directing large volumes of finance into high-carbon assets that cannot be exploited without catastrophic climate effects. They are diverting investment from economic low-carbon alternatives such as solar, wind and hydro-power. And they are undermining the prospects for an ambitious climate deal in 2015. Access full report here For the summary on Australia’s susidisation of it’s fossil fuel industry go to page 51 of the report. The report said that the United States and Australia paid the highest level of national subsidies for exploration in the form of direct spending or tax breaks. Overall, G20 country spending on national subsidies was $23 billion. In Australia, this includes exploration funding for Geoscience Australia and tax deductions for mining and petroleum exploration. The report also classifies the Federal Government’s fuel rebate program for resources companies as a subsidy.

November 2014 – The Fossil Fuel Bailout: G20 subsidies for oil, gas and coal exploration report: Governments across the G20 countries are estimated to be spending $88 billion every year subsidising exploration for fossil fuels. Their exploration subsidies marry bad economics with potentially disastrous consequences for climate change. In effect, governments are propping up the development of oil, gas and coal reserves that cannot be exploited if the world is to avoid dangerous climate change. This report documents, for the first time, the scale and structure of fossil fuel exploration subsidies in the G20 countries. The evidence points to a publicly financed bailout for carbon-intensive companies, and support for uneconomic investments that could drive the planet far beyond the internationally agreed target of limiting global temperature increases to no more than 2ºC. It finds that, by providing subsidies for fossil fuel exploration, the G20 countries are creating a ‘triple-lose’ scenario. They are directing large volumes of finance into high-carbon assets that cannot be exploited without catastrophic climate effects. They are diverting investment from economic low-carbon alternatives such as solar, wind and hydro-power. And they are undermining the prospects for an ambitious climate deal in 2015. Access full report here For the summary on Australia’s susidisation of it’s fossil fuel industry go to page 51 of the report. The report said that the United States and Australia paid the highest level of national subsidies for exploration in the form of direct spending or tax breaks. Overall, G20 country spending on national subsidies was $23 billion. In Australia, this includes exploration funding for Geoscience Australia and tax deductions for mining and petroleum exploration. The report also classifies the Federal Government’s fuel rebate program for resources companies as a subsidy.