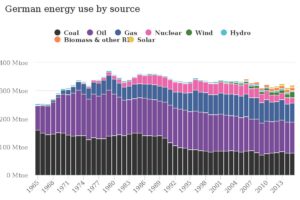

What you will find on this page: LATEST NEWS; Fossil fuel emissions have stalled; Analysis: Record surge of clean energy in 2024 halts China’s CO2 rise; does the world need hydrogen?; Mapped: global coal trade; Complexity of energy systems (maps); Mapped: Germany’s energy sources (interactive access); Power to the people (video); Unburnable Carbon (report); Stern Commission Review; Garnaut reports; live generation data; fossil fuel subsidies; divestment; how to run a divestment campaign guide; local council divestment guide; US coal plant retirement; oil conventional & unconventional; CSG battle in Australia (videos); CSG battle in Victoria; leasing maps for Victoria; coal projects Victoria

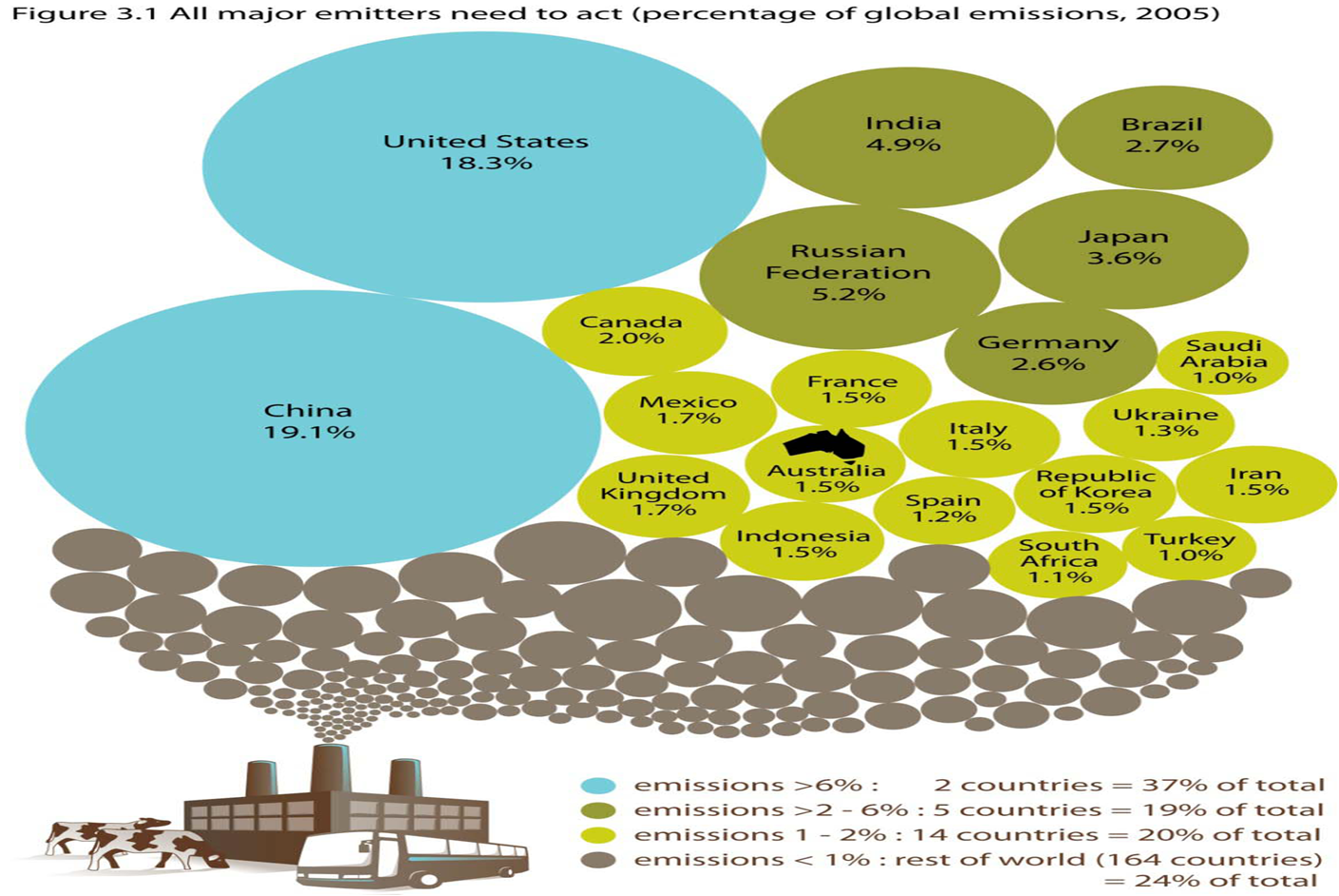

Huge task to decarbonise

Source: Australian Delegation presentation to international forum held in Bonn in May 2012

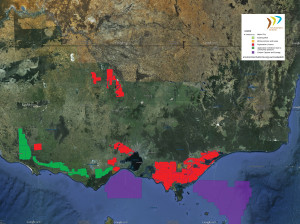

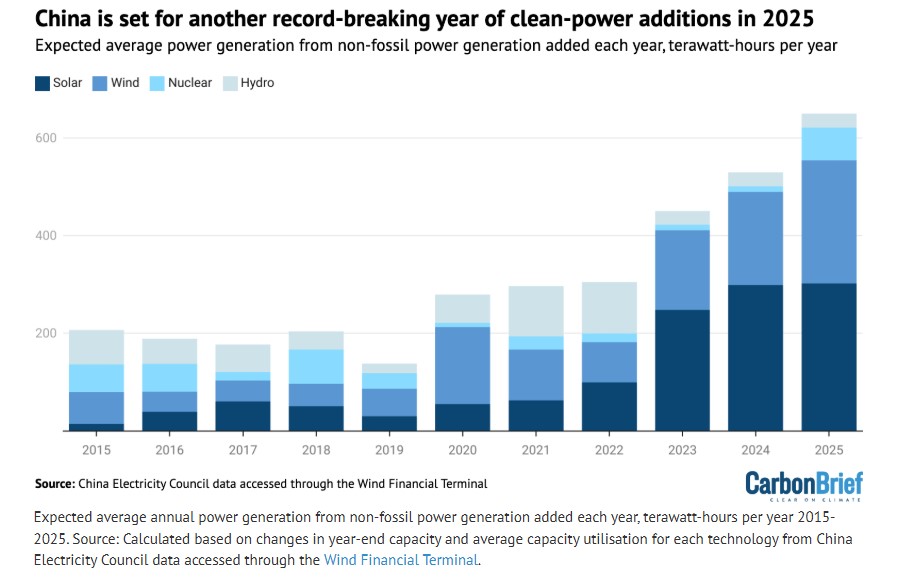

Latest News 7 February 2016, Reuters U.N. agency seeks to end rift on new aircraft emission rules. Europe and the United States tried to bridge differences over emissions standards for aircraft on Sunday as global aviation leaders prepared to adopt new rules that could affect Boeing Co and Airbus Group’s production of the largest jetliners and freighters. Proposals being debated in Montreal by the International Civil Aviation Organization (ICAO), the United Nations’ aviation agency, would force makers of the world’s largest passenger jets to upgrade or stop producing certain models as early as 2023, according to sources close to the negotiations and documents seen by Reuters. U.S. and European negotiators are trying to come up with the world’s first carbon dioxide emissions standards for aircraft as part of the industry’s contribution to efforts to combat climate change. Aviation was not included in the global climate deal agreed by a UN conference in Paris in December, but ICAO is trying to nail down the first of its two-part strategy as soon as Monday after six years of talks. It is due to finalize a market-based mechanism for all airlines later this year. Differences remain on where to place the bar on efficiency, with the United States and Canada pushing for more stringent targets than the European Union, while environmental groups have accused Europe of dragging its feet. “The CO2 standard will push industry to be as fuel-efficient as possible in all market conditions to reduce GHG (greenhouse gas) emissions and the impact of aviation on climate change,” stated the Canadian paper presented at ICAO last week. Read More here 5 February 2016, Renew Economy, Five things we learned this week about Tony Turnbull/ Malcolm Abbott. Remember Tony Abbott? He was the leader of the Coalition government who thought that climate change was crap, dismantled the carbon price, trashed the Climate Council, and tried to dismantle the Climate Change Authority, the Australian Renewable Energy Agency and the Clean Energy Finance Corp. Tony Abbott brought investment in large scale renewable energy to a screeching halt by threatening to kill the renewable energy target, and then cutting it sharply, so encouraging a capital strike by major utilities. He also threatened to decimate the ranks of climate scientists through major cuts to the CSIRO. He said he hated the sight of wind farms, and said he thought coal was good for humanity. Remember Malcolm Turnbull? He was the former Opposition leader who enthusiastically launched the Beyond Zero Emissions Plan for a rapid transition to 100 per cent renewable energy in Australia in 2010, who spoke of the moral and economic importance of acting decisively on climate change, who spoke of Direct Action as “irresponsible” and a “fig leaf” for a climate policy, and who spoke of many fine Liberal policy initiatives in whole sentences. Nearly six months ago, something strange happened. Malcolm Turnbull became prime minister after Tony Abbott was dumped by his own party. But nothing changed. If the swap had been made by deed poll or a cardboard cut-out, the practical impact on climate and clean energy policies would have been no greater. The carbon price is still scrapped, the “fig leaf” remains the centrepiece of the great policy misnomer Direct Action; Australia’s emissions are surging to a record high; the capital strike by utilities continues and large scale renewables investment remains at zero; the legislation to repeal the CCA, ARENA and the CEFC has not been withdrawn; coal is still considered good for humanity, and even a solution to hunger; and 300 or so climate scientists have just been told, in the parlance of modern football, to “do one” by the CSIRO and find another job. Yet, in spite of all this, all Turnbull needs to do to be assured of election victory this year – in the absence of a credible opposition leader – is to make sure he does not actually morph into Tony Abbott. That means woo-ing the “soft centre” who chose to believe – like they did in 2013 – that Tony Abbott would “do the right thing”, despite all the evidence to the contrary. In fact, Malcolm Turnbull doesn’t even need to be Malcolm Turnbull. He certainly doesn’t need to drop Abbott’s policies, and appears to have made a promise not to. A new composite figure, call him Malcolm Abbott or Tony Turnbull, has emerged. How do we know this? Here’s five reasons why: Read More here 4 February 2016, Renew Economy, Adani puts Galilee coal mine on hold pending recovery in coal price. The Indian mining and energy giant Adani Enterprises appears to have put development of its massive and controversial $16 billion Carmichael coal mine in the Galilee Basin on hold – until coal prices show signs of a solid rebound. Which could be never. A report from brooking house Axis Capital in India this week quotes Adani management as saying that no capital expenditure is planned by the company for the project until there is “visibility” of a rebound in the coal price. Given that international coal prices are at record lows, and most analysts predict further falls as the commodity faces increased competition from renewables, and major economies turn away from coal due to environmental and climate impacts, it suggests that Adani accepts that the Galilee Basin may not get developed. This is in complete contrast to the comments attributed by Adani to the Queensland government, where it is apparently trying to sound optimistic about its go-ahead, suggesting it could re-start works within months. The Queensland Labor government this week gave environmental approval for the mine, despite massive concerns about its impact on the Great Barrier Reef and on climate targets. An Adani spokesman was quoted by the Brisbane Courier-Mail as saying: “The company is in a position to resume some of the development and other works on its projects within months of a mining lease being granted.” However, the Axis Capital report (an excerpt of which appears above) quoted Adani management as saying that no capital expenditure is planned for the Galille Basin mine this financial year – and none would be likely in future without “visibility of revival in global coal prices.” Given that the outlook for global coal prices is poor, this suggests that there will be no investment in Galilee, and underscores the difficulty it will have in attracting finance for a project that analysts says will not be economic. Even the conservative International Energy Agency said late last year that it did not expect carmichael and other projects in the Galilee Basin to be built. “It is not likely that the above listed projects will be operational by 2020, if ever,” it said in its latest medium term coal outlook.Read More here 3 February 2016, The Guardian, We’re drowning in cheap oil – yet still taxpayers prop up this toxic industry. Those of us who predicted, during the first years of this century, an imminent peak in global oil supplies could not have been more wrong. People like the energy consultant Daniel Yergin, with whom I disputed the topic, appear to have been right: growth, he said, would continue for many years, unless governments intervened. Oil appeared to peak in the United States in 1970, after which production fell for 40 years. That, we assumed, was the end of the story. But through fracking and horizontal drilling, production last year returned to the level it reached in 1969. Twelve years ago, the Texas oil tycoon T Boone Pickens announced that “never again will we pump more than 82 million barrels”. By the end of 2015, daily world production reached 97m . Instead of a collapse in the supply of oil, we confront the opposite crisis: we’re drowning in the stuff. The reasons for the price crash – an astonishing slide from $115 a barrel to less than $30 over the past 20 months – are complex: among them are weaker demand in China and a strong dollar. But an analysis by the World Bank finds that changes in supply have been a much greater factor than changes in demand. Oil production has almost doubled in Iraq, as well as in the US. Saudi Arabia has opened its taps, to try to destroy the competition and sustain its market share – a strategy that some peak oil advocates once argued was impossible. Read More here 4 October 2017, The Conversation, Why are we still pursuing the Adani Carmichael mine? Why, if Adani’s gigantic Carmichael coal project is so on-the-nose for the banks and so environmentally destructive, are the federal and Queensland governments so avid in their support of it? Once again the absurdity of building the world’s biggest new thermal coal mine was put in stark relief on Monday evening via an ABC Four Corners investigation, Digging into Adani. Where the ABC broke new ground was in exposing the sheer breadth of corruption by this Indian energy conglomerate. And its power too. The TV crew was detained and questioned in an Indian hotel for five hours by police. It has long been the subject of high controversy that the Australian government, via the Northern Australia Infrastructure Facility (NAIF)that is still contemplating a A$1 billion subsidy for Adani’s rail line, a proposal to freight the coal from the Galilee Basin to Adani’s port at Abbot Point on the Great Barrier Reef. But more alarming still, and Four Corners touched on this, is that the federal government is also considering using taxpayer money to finance the mine itself, not just the railway. No investors in sight As private banks have walked away from the project, the only way Carmichael can get finance is with the government providing guarantees to a private banking syndicate, effectively putting taxpayers on the hook for billions of dollars in project finance. The prospect is met with the same incredulity in India as it is here in Australia: Read More here 4 October 2017, The Conversation, Australia’s $1 billion loan to Adani is ripe for a High Court challenge. Indian mining giant Adani’s proposal to build Australia’s largest coal mine in Queensland’s Galilee Basin has been the source of sharp national controversy, because of its potential economic, health, evironmental and cultural risks. These concerns were amplified this week when India’s former environment minister Jairam Ramesh told the ABC’s Four Corners: My message to the Australian government would certainly be: please demonstrate that you have done more homework than has been the case so far. It’s a valid warning, considering that a Commonwealth investment board is considering loaning Adani A$1 billion in federal money to assist the development of mining infrastructure. The loan, expected to be announced any day now, will no doubt agitate further political controversy. It is also likely to pave the way for yet more court challenges against Adani’s proposal. Read More here 3 October 2017, The Guardian, Voters back fracking bans despite pressure on states to drop them. Despite the Turnbull government’s insistence that state-based restrictions on unconventional gas extraction are putting Australia’s energy security at risk, twice as many voters support the bans as oppose them. A new poll, conducted by the progressive thinktank the Australia Institute, has found 49% of Australians support a moratorium on fracking for gas in their own state, while just 24% oppose it. It also found 74% of Australians support an increased renewable energy target in their own state, demonstrating support for state-based renewable energy targets is largely unchanged since March 2016. The Australia Institute survey of 1,421 Australians took place between 17 and 26 September. It asked voters if they supported or opposed their state governments implementing a moratorium on fracking for gas and an increased renewable energy target. The poll ended last week just as the prime minister, Malcolm Turnbull, wrote to the New South Wales premier, Gladys Berejiklian, the Victorian premier, Daniel Andrews, and the Northern Territory chief minister, Michael Gunner, asking them to lift their “blanket moratoriums” on new gas production and warning they were putting Australia’s energy security and industries at risk. Read More here 3 October 2017, The Guardian, Catholic church to make record divestment from fossil fuels. More than 40 Catholic institutions are to announce the largest ever faith-based divestment from fossil fuels, on the anniversary of the death of St Francis of Assisi. The sum involved has not been disclosed but the volume of divesting groups is four times higher than a previous church record, and adds to a global divestment movement, led by investors worth $5.5tn. Christiana Figueres, the former UN climate chief who helped negotiate the Paris climate agreement, hailed Tuesday’s move as “a further sign we are on the way to achieving our collective mission”. She said: “I hope we will see more leaders like these 40 Catholic institutions commit, because while this decision makes smart financial sense, acting collectively to deliver a better future for everybody is also our moral imperative.” Church institutions joining the action include the Archdiocese of Cape Town, the Episcopal Conference of Belgium and the diocese of Assisi-Nocera Umbra-Gualdo Tadino, the spiritual home of the world’s Franciscan brothers. Read More here 18 May 2023, NOAA – Climate .gov: As we blogged about earlier this month, the odds that El Niño—the warm phase of the planet’s most powerful natural climate pattern, the El Niño-Southern Oscillation—will emerge in the tropical Pacific Ocean later this year continue to rise. One sign that El Niño is on its way is the rapid shift from cool to warm ocean surface temperatures in the heart of the tropical Pacific. This animation shows weekly temperatures across the Pacific Ocean compared to the long-term average from December 5 to May 14. Cooler-than-average waters are blue; warmer than average waters are orange to red. The key area for monitoring La Niña and El Niño is outlined with a black rectangle. Week by week, cooler surface waters are gradually replaced by warmer waters from the east. Read more here. 17 May 2023, The Conversation: Global warming to bring record hot year by 2028 – probably our first above 1.5°C limit. One year in the next five will almost certainly be the hottest on record and there’s a two-in-three chance a single year will cross the crucial 1.5℃ global warming threshold, an alarming new report by the World Meteorological Organization predicts. The report, known as the Global Annual to Decadal Climate Update, warns if humanity fails to reduce greenhouse gas emissions to net zero, increasingly worse heat records will tumble beyond this decade. So what is driving the bleak outlook for the next five years? An expected El Niño, on top of the overall global warming trend, will likely push the global temperature to record levels. Has the Paris Agreement already failed if the global average temperature exceeds the 1.5℃ threshold in one of the next five years? No, but it will be a stark warning of what’s in store if we don’t quickly reduce emissions to net zero. Warming makes record heat inevitable. The World Meteorological Organization update says there is a 98% chance at least one of the next five years will be the hottest on record. And there’s a 66% chance of at least one year over the 1.5℃ threshold. There’s also a 32% chance the average temperature over the next five years will exceed the 1.5℃ threshold. The chance of temporarily exceeding 1.5℃ has risen steadily since 2015, when it was close to zero. For the years between 2017 and 2021, it was a 10% chance. Read more here 12 May 2023, The Gurdian. Albanese government approves first new coalmine since taking power. The Australian government has approved a new coalmine development for the first time since it was elected last year. Tanya Plibersek, the federal environment minister, indicated she would give the green light to the Isaac River coalmine in Queensland’s Bowen basin. It was announced late on Thursday. The mine, to be developed by Bowen Coking Coal, is planned for 28km east of Moranbah, next to five other coalmines, and expected to produce about 500,000 tonnes of metallurgical coal a year for five years. Metallurgical coal, also known as coking coal, is used in steelmaking. “The Albanese government has to make decisions in accordance with the facts and the national environment law – that’s what happens on every project, and that’s what’s happened here,” a spokesperson for Plibersek said. “Since the election we’ve doubled renewable energy approvals to a record high. The government will continue to consider each project on a case-by-case basis, under the law.” The government said no submissions had been received about the project during the public consultation period, including from environment groups. Read more here 5 May 2023, The Conversation. Humanity’s tipping point? How the Queen’s death stole a climate warning’s thunder. Think back to September last year. What happened early that month? What news shook the world and reverberated for weeks, if not months? That’s a question I’ve been asking friends and colleagues lately. On September 8, 2022, at 6.30pm in Britain, Buckingham Palace announced the death of Queen Elizabeth II. The news broke just 30 minutes before the press embargo lifted on a major review of climate change tipping points in the journal Science. The paper in Science was truly earth-shattering, as it heralded changes that could threaten the future of civil society on this planet. But it was the other news that captured the world’s attention. Grappling with tipping points. The question of when global warming might push elements of the climate system past points of no return has come into focus over last the decade or so. And tipping points once thought to be far off in the distance have come into sharp relief. The research examines major features of the global climate system, such as ice sheets, glaciers, rainforests and coral reefs. It asks when melting of ice sheets on Greenland and West Antarctica would become irreversible, ultimately contributing many metres to sea level. Or when thawing of frozen ground in the Arctic might start producing so much methane and carbon dioxide (CO₂) that it blows the global emissions budget. Amazonian forest die-back is another major part of the Earth’s climate system. Global heating and regional reductions in rainfall could cause trees to die, releasing large amounts of greenhouse gases. Fewer trees ultimately means less rainfall for those that remain, creating a vicious cycle. Read more here 27 January 2025, Carbon Brief: A record surge of clean energy kept China’s carbon dioxide (CO2) emissions below the previous year’s levels in the last 10 months of 2024. However, the new analysis for Carbon Brief, based on official figures and commercial data, shows the tail end of China’s rebound from zero-Covid in January and February, combined with abnormally high growth in energy demand, stopped CO2 emissions falling in 2024 overall. While China’s CO2 output in 2024 grew by an estimated 0.8% year-on-year, emissions were lower than in the 12 months to February 2024. Other key findings of the analysis include: As ever, the latest analysis shows that policy decisions made in 2025 will strongly affect China’s emissions trajectory in the coming years. In particular, both China’s new commitments under the Paris Agreement and the country’s next five-year plan are being prepared in 2025. Read More Here 3 November 2020, Carbon Brief: Hydrogen gas has long been recognised as an alternative to fossil fuels and a potentially valuable tool for tackling climate change. Now, as nations come forward with net-zero strategies to align with their international climate targets, hydrogen has once again risen up the agenda from Australia and the UK through to Germany and Japan. In the most optimistic outlooks, hydrogen could soon power trucks, planes and ships. It could heat homes, balance electricity grids and help heavy industry to make everything from steel to cement. But doing all these things with hydrogen would require staggering quantities of the fuel, which is only as clean as the methods used to produce it. Moreover, for every potentially transformative application of hydrogen, there are unique challenges that must be overcome. In this in-depth Q&A – which includes a range of infographics, maps and interactive charts, as well as the views of dozens of experts – Carbon Brief examines the big questions around the “hydrogen economy” and looks at the extent to which it could help the world avoid dangerous climate change. Access full article here Fossil fuel emissions have stalled 14 November 2016, The Conversation, Fossil fuel emissions have stalled: Global Carbon Budget 2016. For the third year in a row, global carbon dioxide emissions from fossil fuels and industry have barely grown, while the global economy has continued to grow strongly. This level of decoupling of carbon emissions from global economic growth is unprecedented.Global CO₂ emissions from the combustion of fossil fuels and industry (including cement production) were 36.3 billion tonnes in 2015, the same as in 2014, and are projected to rise by only 0.2% in 2016 to reach 36.4 billion tonnes. This is a remarkable departure from emissions growth rates of 2.3% for the previous decade, and more than 3% during the 2000’s. Read More here Do you want to understand the complexity of energy systems which support our high consumption lifestyles? Most people don’t give too much thought to where their electricity comes from. Flip a switch, and the lights go on. That’s all. The origins of that energy, or how it actually got into our homes, is generally hidden from view. This link will take you to 11 maps which explain energy in America (it is typical enough as an example of a similar lifestyle as Australia – when I find maps for Oz I’ll add them in) e.g. above map showing the coal plants in the US. Source: Vox Explainers Mapped: how Germany generates its electricity – another example Power to the People – Lock the Gate looks back at the wins of 2015 And there’s lots more coming up in 2016. Some of the big priorities coming up next for the “Lock the Gate” movement are: If you want to give “Lock the Gate” your support – go here for more info This new report reveals that the pollution from Australia’s coal resources, particularly the enormous Galilee coal basin, could take us two-thirds of the way to a two degree rise in global temperature. To Read More and download report The 2006 UK government commissioned Stern Commission Review on the Economics of Climate Change is still the best complete appraisal of global climate change economics. The review broke new ground on climate change assessment in a number of ways. It made headlines by concluding that avoiding global climate change catastrophe was almost beyond our grasp. It also found that the costs of ignoring global climate change could be as great as the Great Depression and the two World Wars combined. The review was (still is) in fact a very good assessment of global climate change, which inferred in 2006 that the situation was a global emergency. Read More here The Garnaut Climate Change Review was commissioned by the Commonwealth, state and territory governments in 2007 to conduct an independent study of the impacts of climate change on the Australian economy. Prof. Garnaut presented The Garnaut Climate Change Review: Final Report to the Australian Prime Minister, Premiers and Chief Ministers in September 2008 in which he examined how Australia was likely to be affected by climate change, and suggested policy responses. In November 2010, he was commissioned by the Australian Government to provide an update to the 2008 Review. In particular, he was asked to examine whether significant changes had occurred that would affect the analysis and recommendations from 2008. The final report was presented May 2011. Since then the Professor has regularly participated in the debate of fossil fuel reduction, as per his latest below: To access his reports; interviews; submissions go here 27 May 2015, Renew Economy, Garnaut: Cost of stranded assets already bigger than cost of climate action. This is one carbon budget that Australia has already blown. Economist and climate change advisor Professor Ross Garnaut has delivered a withering critique of Australia’s economic policies and investment patterns, saying the cost of misguided over-investment in the recent mining boom would likely outweigh the cost of climate action over the next few decades. Read More here Live generation of electricity by fuel type Fossil Fuel Subsidies – The Age of entitlement continues 24 June 2014, Renew Economy, Age of entitlement has not ended for fossil fuels: A new report from The Australia Institute exposes the massive scale of state government assistance, totalling $17.6 billion over a six-year period, not including significant Federal government support and subsidies. Queensland taxpayers are providing the greatest assistance by far with a total of $9.5 billion, followed by Western Australia at $6.2 billion. The table shows almost $18 billion dollars has been spent over the past 6 years by state governments, supporting some of Australia’s biggest, most profitable industries, which are sending most of the profits offshore. That’s $18 billion dollars that could have gone to vital public services such as hospitals, schools and emergency services. State governments are usually associated with the provision of essential services like health and education so it will shock taxpayers to learn of the massive scale of government handouts to the minerals and fossil fuel industries. This report shows that Australian taxpayers have been misled about the costs and benefits of this industry, which we can now see are grossly disproportionate. Each state provides millions of dollars’ worth of assistance to the mining industry every year, with the big mining states of Queensland and Western Australia routinely spending over one billion dollars in assistance annually. Read More here – access full report here What is fossil fuel divestment? Local Governments ready to divest Aligning Council Money With Council Values A Guide To Ensuring Council Money Isn’t Funding Climate Change. 350.org Australia – with the help of the incredible team at Earth Hour – has pulled together a simple 3-step guide for local governments interested in divestment. The movement to align council money with council values is constantly growing in Australia. It complements the existing work that councils are doing to shape a safe climate future. It can also help to reshape the funding practices of Australia’s fossil fuel funding banks. The steps are simple. The impact is huge.The guide can also be used by local groups who are interested in supporting their local government to divest as a step-by-step reference point. Access guide here How coal is staying in the ground in the US Sierra Club Beyond Coal Campaign May 2015, Politico, Michael Grunwald: The war on coal is not just political rhetoric, or a paranoid fantasy concocted by rapacious polluters. It’s real and it’s relentless. Over the past five years, it has killed a coal-fired power plant every 10 days. It has quietly transformed the U.S. electric grid and the global climate debate. The industry and its supporters use “war on coal” as shorthand for a ferocious assault by a hostile White House, but the real war on coal is not primarily an Obama war, or even a Washington war. It’s a guerrilla war. The front lines are not at the Environmental Protection Agency or the Supreme Court. If you want to see how the fossil fuel that once powered most of the country is being battered by enemy forces, you have to watch state and local hearings where utility commissions and other obscure governing bodies debate individual coal plants. You probably won’t find much drama. You’ll definitely find lawyers from the Sierra Club’s Beyond Coal campaign, the boots on the ground in the war on coal. Read More here Oil – conventional & unconventional May 2015, Oil change International Report: On the Edge: 1.6 Million Barrels per Day of Proposed Tar Sands Oil on Life Support. The Canadian tar sands is among the most carbon-intensive, highest-cost sources of oil in the world. Even prior to the precipitous drop in global oil prices late last year, three major projects were cancelled in the sector with companies unable to chart a profitable path forward. Since the collapse in global oil prices, the sector has been under pressure to make further cuts, leading to substantial budget cuts, job losses, and a much more bearish outlook on expansion projections in the coming years. Read full report here. For summary of report USA Sierra Club Beyond Oil Campaign Coal Seam Gas battle in Australia Lock the Gate Alliance is a national coalition of people from across Australia, including farmers, traditional custodians, conservationists and urban residents, who are uniting to protect our common heritage – our land, water and communities – from unsafe or inappropriate mining for coal seam gas and other fossil fuels. Read more about the missions and principles of Lock the Gate. Access more Lock the Gate videos here. Access Lock the Gate fact sheets here 2014: Parliament of Victoria Research Paper: Unconventional Gas: Coal Seam Gas, Shale Gas and Tight Gas: This Research Paper provides an introduction and overview of issues relevant to the development of unconventional gas – coal seam, shale and tight gas – in the Australian and specifically Victorian context. At present, the Victorian unconventional gas industry is at a very early stage. It is not yet known whether there is any coal seam gas or shale gas in Victoria and, if there is, whether it would be economically viable to extract it. A moratorium on fracking has been in place in Victoria since August 2012 while more information is gathered on potential environmental risks posed by the industry. The parts of Victoria with the highest potential for unconventional gas are the Gippsland and Otway basins. Notably, tight gas has been located near Seaspray in Gippsland but is not yet being produced. There is a high level of community concern in regard to the potential impact an unconventional gas industry could have on agriculture in the Gippsland and Otway regions. Industry proponents, however, assert that conventional gas resources are declining and Victoria’s unconventional gas resources need to be ascertained and developed. Read More here 28 January 2015, ABC News, Coal seam gas exploration: Victoria’s fracking ban to remain as Parliament probes regulations: A ban on coal seam gas (CSG) exploration will stay in place in Victoria until a parliamentary inquiry hands down its findings, the State Government has promised. There is a moratorium on the controversial mining technique, known as fracking, until the middle of 2015. The Napthine government conducted a review into CSG, headed by former Howard government minister Peter Reith, which recommended regulations around fracking be relaxed. Labor was critical of the review, claiming it failed to consult with farmers, environmental scientists and local communities. Read more here Keep up to date and how you can be involved here Friends of the Earth Melbourne Coal & Gas Free Victoria 20 May 2015, FoE, Inquiry into Unconventional Gas: Check here for details on the Victorian government’s Inquiry into unconventional gas. The public hearings have not yet started, however the Terms of Reference have been released. The state government’s promised Inquiry into Unconventional Gas has now been formally announced, with broad terms of reference (TOR). FoE’s response to the TOR is available here. The Upper House Environment and Planning Committee will manage the Inquiry. You can find the Inquiry website here. The final TOR will be determined by the committee. Significantly, it is a cross party committee. The Chair is a Liberal (David Davis), and there is one National (Melinda Bath), one Green (Samantha Dunn), three from the ALP (Gayle Tierney, Harriet Shing, Shaun Leane), an additional MP from the Liberals (Richard Dalla-Riva), and one MP from the Shooters Party (Daniel Young). Work started by the previous government, into water tables and the community consultation process run by the Primary Agency, will be released as part of the inquiry.The moratorium on unconventional gas exploration will stay in place until the inquiry delivers its findings. The interim report is due in September and the final report by December. There is the possibility that the committee will amend this timeline if they are overwhelmed with submissions or information. Parliament will then need to consider the recommendations of the committee and make a final decision about how to proceed. This is likely to happen when parliament resumes after the summer break, in early 2016. Quit Coal is a Melbourne-based collective that campaigns against the expansion of the coal and unconventional gas industries in Victoria. Quit Coal uses a range of tactics to tackle this problem. We advise the broader Victorian community about plans for new coal and unconventional gas projects, we put pressure on our government to stop investing in these projects, and we help to inform and mobilise Victorian communities so they can campaign on their own behalf. We focus on being strategic, creative, and as much as possible, fun! The above screen shot is of the Victorian State government’s Mining Licences Near Me site. Go to this link to see what is happening in your area Environment Victoria’s campaign CoalWatch is an interactive resource that tracks the coal industry’s expansion plans and helps builds a movement to stop these polluting developments. CoalWatch provides a way for everyday Victorians to keep track of the coal industry’s ambitious expansion plans. To check what tax-payer money has been pledged to brown coal projects and the coal projects industry is spruiking to our politicians. Here’s another map via EV website (go to their website and you should be able to get better detail from Google Maps: Red areas: Exploration licences (EL). These areas are held by companies to undertake exploration activity. A small bond is held by government in case of any damage. If a company wants to progress the project it needs to obtain a mining licence. Exploration Licence applications are marked with an asterix in the Places Index eg. EL4684*. Yellow areas: Mining Licences (MIN). A mining licence is granted with the expectation that mining will occur. A larger bond is paid to government. Green areas: Exploration licences that have been withdrawn or altered due to community concern. Green outline: Existing mines within Mining Licences. Purple areas: Geological Carbon Storage Exploration areas for carbon capture and storage. On-shore areas have been released by the State Government, while off-shore areas have been released by the Federal Government. The Coal Watch wiki tracks current and future Victorian coal projects, whether they are power stations, coal mines, proposals to export coal or some other inventive way of burning more coal. To get the full picture of coal in Victoria visit our wiki page. Get more info and see the full list of Exploration Licences current at 17 August 2012 here August 2015, Institute for Energy Economics & Financial Analysis – powerpoint: Changing Dynamics in the Global Seaborne Thermal Coal Markets and Stranded Asset Risk. Information from one of the slides follows. To view full presentation go here Economic Implications for Australia 83% of Australian coal mines are foreign owned, hence direct leverage of fossil fuels to the ASX is relatively small at 1-2%. However, for Australia the exposure is high, time is needed for transition and the new industry opportunities are significant: 1. Energy Infrastructure: Australia spends $5-10bn pa on electricity / grid sector, much of it a regulated asset base that all ratepayers fund much of it stranded. BNEF estimate of Australia’s renewable energy infrastructure investment for 2015-2020 was cut 30% from A$20bn post RET. Lost opportunities. 2. Direct employment: The ABS shows a fall of ~20k from the 2012 peak of 70K from coal mining across Australia, and cuts are ongoing. Indirect employment material. 3. Terms of trade: BZE estimates the collapse in the pricing of iron ore, coal and LNG cuts A$100bn pa from Australia’s export revenues by 2030, a halving relative to government budget estimates of 2013/14. Coal was 25% of NSW’s total A$ value of exports in 2013/14 (38% of Qld). Australia will be #1 globally in LNG by 2018. 4. The financial sector: is leveraged to mining and associated rail port infrastructure. WICET 80% financed by banks, mostly Australian. Adani’s Abbot Point Port is foreign owned, but A$1.2bn of Australian sourced debt. Insurance firms and infrastructure funds are leveraged to fossil fuels vs little RE infrastructure assets. BBY! 5. Rehabilitation: $18bn of unfunded coal mining rehabilitation across Australia. 6. Economic growth: curtailed as Australia fails to develop low carbon industries. Analysis: Record surge of clean energy in 2024 halts China’s CO2 rise

In-depth Q&A: Does the world need hydrogen to solve climate change?

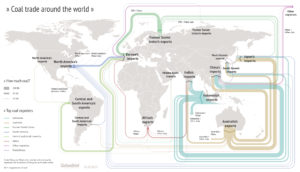

3 May 2016, Carbon Brief, The global coal trade doubled in the decade to 2012 as a coal-fueled boom took hold in Asia. Now, the coal trade seems to have stalled, or even gone into reverse. This change of fortune has devastated the coal mining industry, with Peabody – the world’s largest private coal-mining company – the latest of 50 US firms to file for bankruptcy. It could also be a turning point for the climate, with the continued burning of coal the biggest difference between business-as-usual emissions and avoiding dangerous climate change. Carbon Brief has produced a series of maps and interactive charts to show how the global coal trade is changing. As well as providing a global overview, we focus on a few key countries: Read More here

3 May 2016, Carbon Brief, The global coal trade doubled in the decade to 2012 as a coal-fueled boom took hold in Asia. Now, the coal trade seems to have stalled, or even gone into reverse. This change of fortune has devastated the coal mining industry, with Peabody – the world’s largest private coal-mining company – the latest of 50 US firms to file for bankruptcy. It could also be a turning point for the climate, with the continued burning of coal the biggest difference between business-as-usual emissions and avoiding dangerous climate change. Carbon Brief has produced a series of maps and interactive charts to show how the global coal trade is changing. As well as providing a global overview, we focus on a few key countries: Read More here/cdn0.vox-cdn.com/uploads/chorus_asset/file/3915730/EIA%20coal%20power%20plants.png)

21 April 2015, Climate Council, Will Steffen: Unburnable Carbon: Why we need to leave fossil fuels in the ground.Stern Commission Review

Australia’s Garnaut Review

November 2014 – The Fossil Fuel Bailout: G20 subsidies for oil, gas and coal exploration report: Governments across the G20 countries are estimated to be spending $88 billion every year subsidising exploration for fossil fuels. Their exploration subsidies marry bad economics with potentially disastrous consequences for climate change. In effect, governments are propping up the development of oil, gas and coal reserves that cannot be exploited if the world is to avoid dangerous climate change. This report documents, for the first time, the scale and structure of fossil fuel exploration subsidies in the G20 countries. The evidence points to a publicly financed bailout for carbon-intensive companies, and support for uneconomic investments that could drive the planet far beyond the internationally agreed target of limiting global temperature increases to no more than 2ºC. It finds that, by providing subsidies for fossil fuel exploration, the G20 countries are creating a ‘triple-lose’ scenario. They are directing large volumes of finance into high-carbon assets that cannot be exploited without catastrophic climate effects. They are diverting investment from economic low-carbon alternatives such as solar, wind and hydro-power. And they are undermining the prospects for an ambitious climate deal in 2015. Access full report here For the summary on Australia’s susidisation of it’s fossil fuel industry go to page 51 of the report. The report said that the United States and Australia paid the highest level of national subsidies for exploration in the form of direct spending or tax breaks. Overall, G20 country spending on national subsidies was $23 billion. In Australia, this includes exploration funding for Geoscience Australia and tax deductions for mining and petroleum exploration. The report also classifies the Federal Government’s fuel rebate program for resources companies as a subsidy.

November 2014 – The Fossil Fuel Bailout: G20 subsidies for oil, gas and coal exploration report: Governments across the G20 countries are estimated to be spending $88 billion every year subsidising exploration for fossil fuels. Their exploration subsidies marry bad economics with potentially disastrous consequences for climate change. In effect, governments are propping up the development of oil, gas and coal reserves that cannot be exploited if the world is to avoid dangerous climate change. This report documents, for the first time, the scale and structure of fossil fuel exploration subsidies in the G20 countries. The evidence points to a publicly financed bailout for carbon-intensive companies, and support for uneconomic investments that could drive the planet far beyond the internationally agreed target of limiting global temperature increases to no more than 2ºC. It finds that, by providing subsidies for fossil fuel exploration, the G20 countries are creating a ‘triple-lose’ scenario. They are directing large volumes of finance into high-carbon assets that cannot be exploited without catastrophic climate effects. They are diverting investment from economic low-carbon alternatives such as solar, wind and hydro-power. And they are undermining the prospects for an ambitious climate deal in 2015. Access full report here For the summary on Australia’s susidisation of it’s fossil fuel industry go to page 51 of the report. The report said that the United States and Australia paid the highest level of national subsidies for exploration in the form of direct spending or tax breaks. Overall, G20 country spending on national subsidies was $23 billion. In Australia, this includes exploration funding for Geoscience Australia and tax deductions for mining and petroleum exploration. The report also classifies the Federal Government’s fuel rebate program for resources companies as a subsidy.